Real Time Trading Service

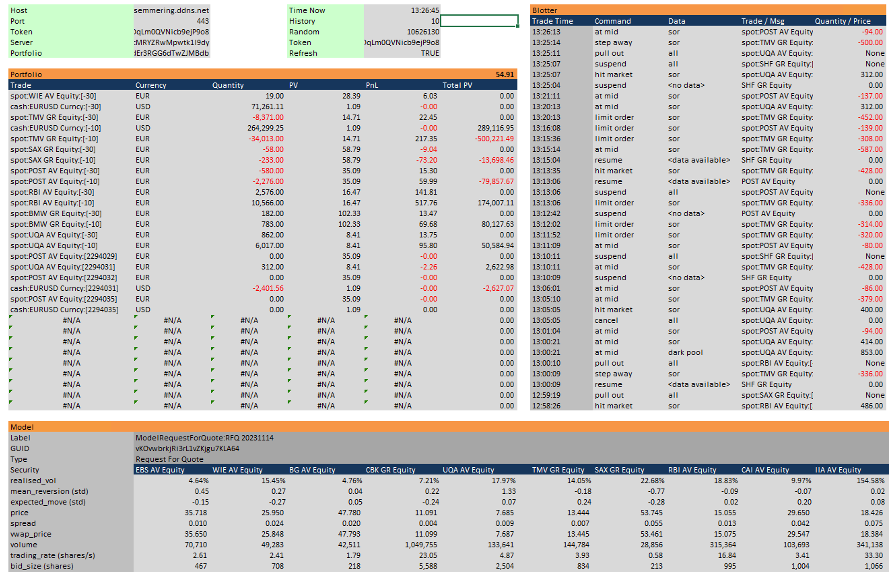

- Real Time Trading Server

- Running as cloud service or on premise

- Can trade up to 100+ names simultaneously

- Parallel design scales optimally with number of underlyings

- WebAPI or Excel addins to access and monitor service

- Integration with Bloomberg real time data stream (BPIPE), Bloomberg static data (Datalicence)

- Execution via direct FIX 4.2 connection to brokers or Bloomberg FixNet

- Detailed ability to customise according to brokers, products and markets

- High reliability (more than 99.5% uptime) over a track record of 2.5 years.

- Implement and backtest Models and Strategies

- AI execution model and strategy available

- Trade on lit markets and dark pools to optimally source available liquidity

- Trade futures and stocks on multiple underlyings

- Various calibration and testing functions available to add new underlyings and recalibrtate to new market conditions

- Models to predict price moves and available liquidity according to market state

- High flexibility with ability extend to your models and strategies as needed

- Large set of unit, functionality and integration tests available

- Integration into Imagine RiskSmart available

- Risk manage linear and non-linear risk of your portfolio dynamically

- Overlay with trading strategies (Range / Spread / Auction Strategies etc.)

- RFQ functionality available to trade against service in real time

- Front to back service combining

- Real Time Data Analysis

- Real Time decision making and trading

- Execution of trades through FIX 4.2

- Restructuring of trades through FIX 4.2

- Real time risk managment as well as booking into back office systems as required.

The Real Time Trading Service is ideally suited to small funds who want to aquire a comprehensive front to back trading solution. The system is scalable and open, so new strategies and models and models can be easily added to the framework. Modular design of the software makes it easy for funds to implement and test their own strategies. Backtesting is implemented as an integrated process, such that models and strategies will run in exactly the same way as a back test and in a live trading situation.

If you are interested in a demo, or would like more information on the Real Time Trading Service, please contact us on info@tars-consulting.com.

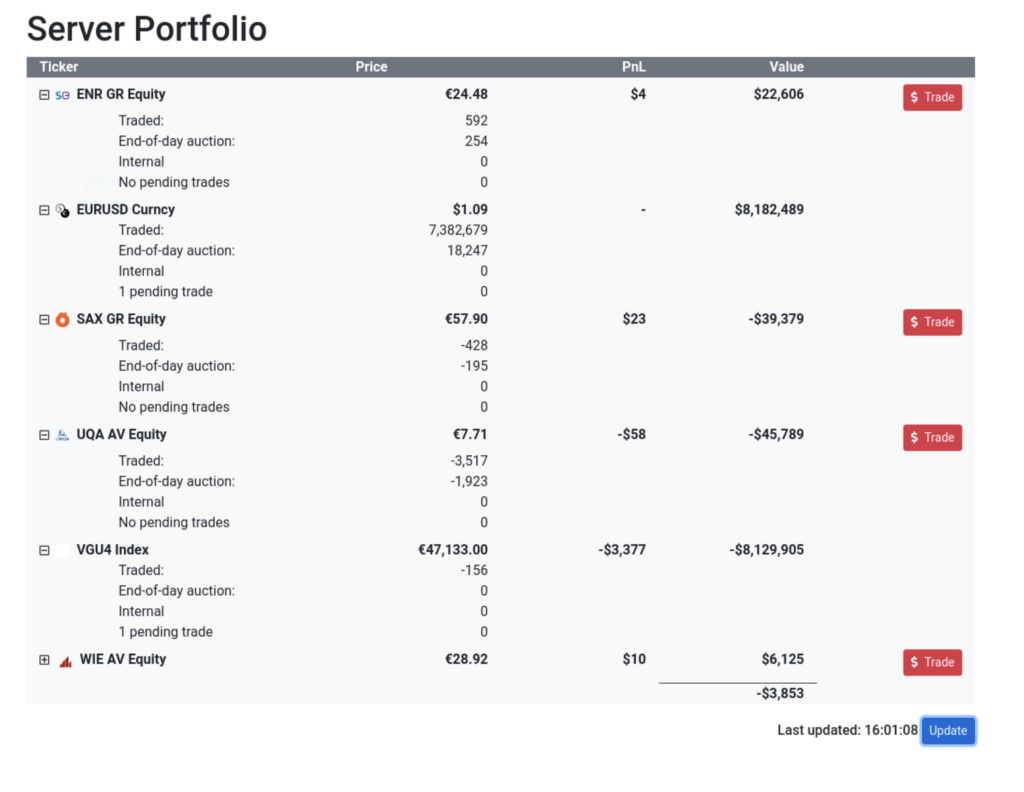

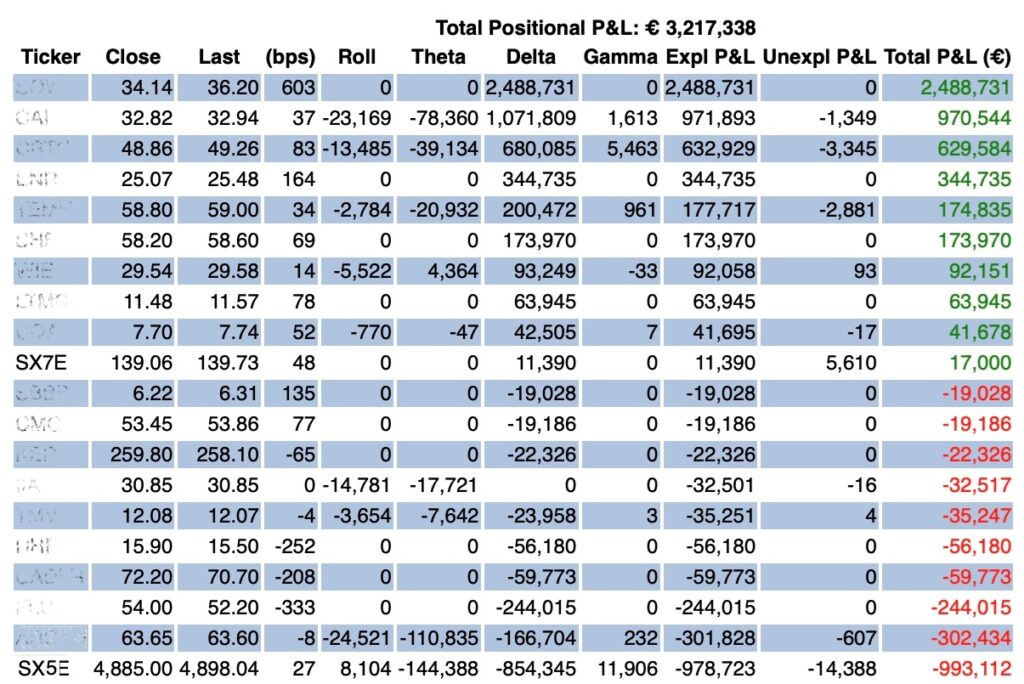

Real Time Data Reporting Service

- Real time PnL – ticking PnL for funds and subfunds

- Uses real time published market data

- Risk metrics (delta, gamma, vega etc. can either be computed or loaded from the booking / risk systems)

- API to Imagine RiskSmart is Imagine TS1 available

- Compares full reval PnL to risk prediction to indicate quality of risk factors

- Posibility to add intraday trading activity into the PnL

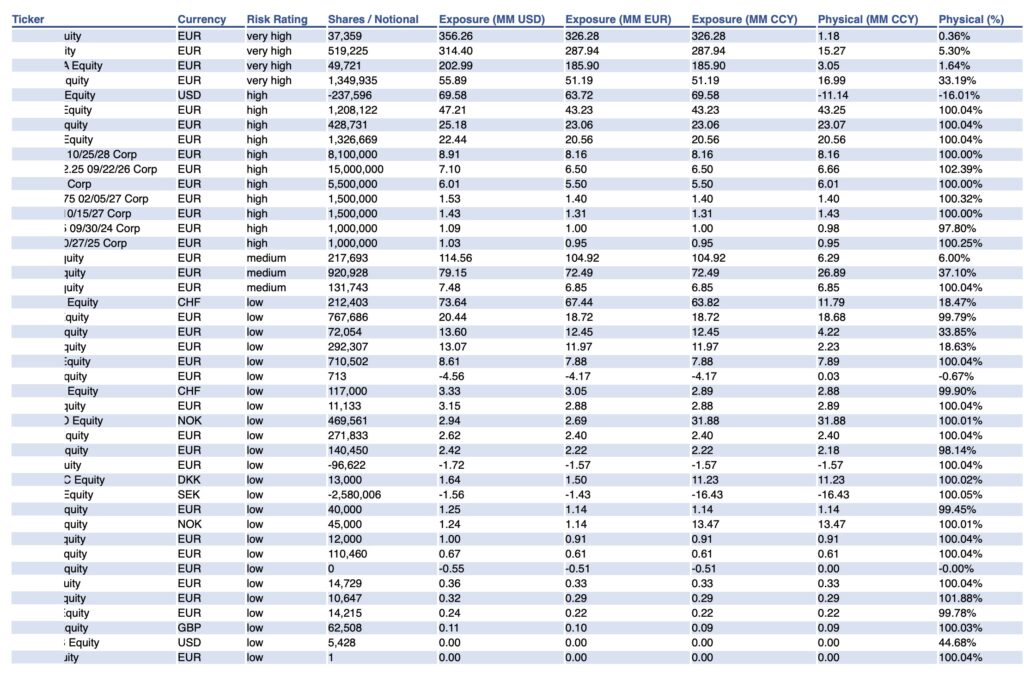

- Real time or EoD exposure and risk reporting.

- Aggregates traded and EoD positions from booking system.

- Computes risk rating including stock correlations, volatility, liquidity and positions size

- Can easily be extended to cover new risk metrics and analytics as needed

- Can be integrated into a web service or periodically sent as an email

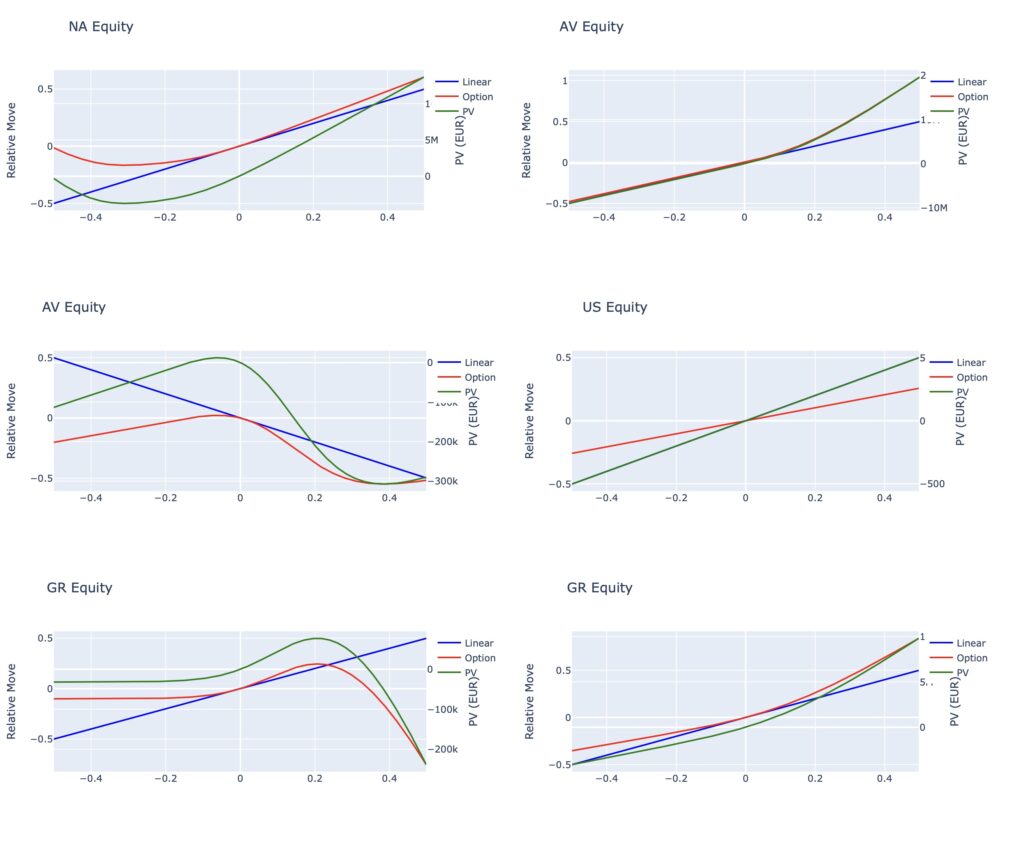

- Nonlinlinear risk real time scenario reporting.

- Real time view of future profit / loss and risk scenarios across your portfolio

- Fully customisable live view

- Can be integrated into a web viewer or alternatively sent by mail

The Real Time Data Reporting Service is a modular platform of analytics coupled with a source of market data that can given you an edge in providing you with up to date information in your portfolio, PnL and risk. The platform is fully customisable so we can quickly implement views and metrics as required. The reports above are only a small subset of the available reports which have been implemented to date. The reporting service is integrated with the Imagine RiskSmart and TS1 software suites, but can be extended to other data sources as required.

If you are interested to obtain more information on the Real Time Data Reporting Service please contact us on info@tars-consulting.com.

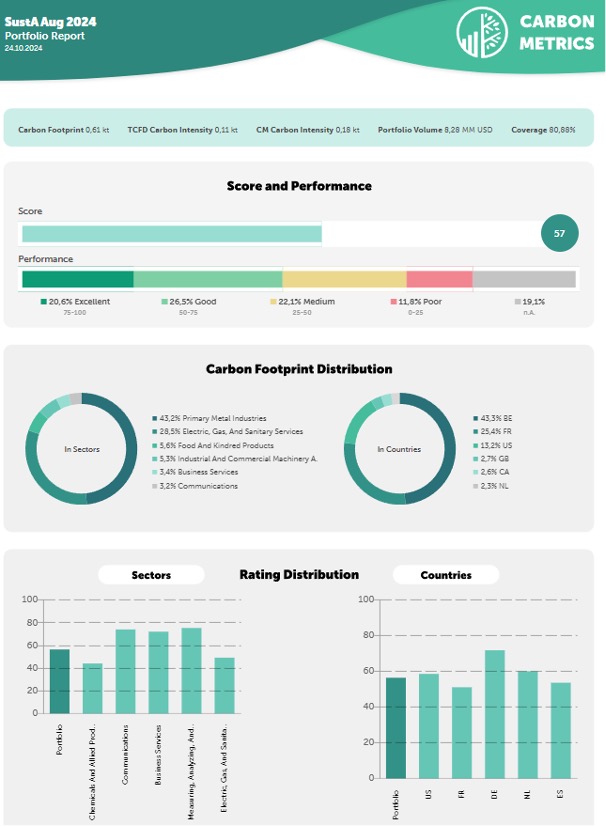

Carbon Metrics CO2 Computation

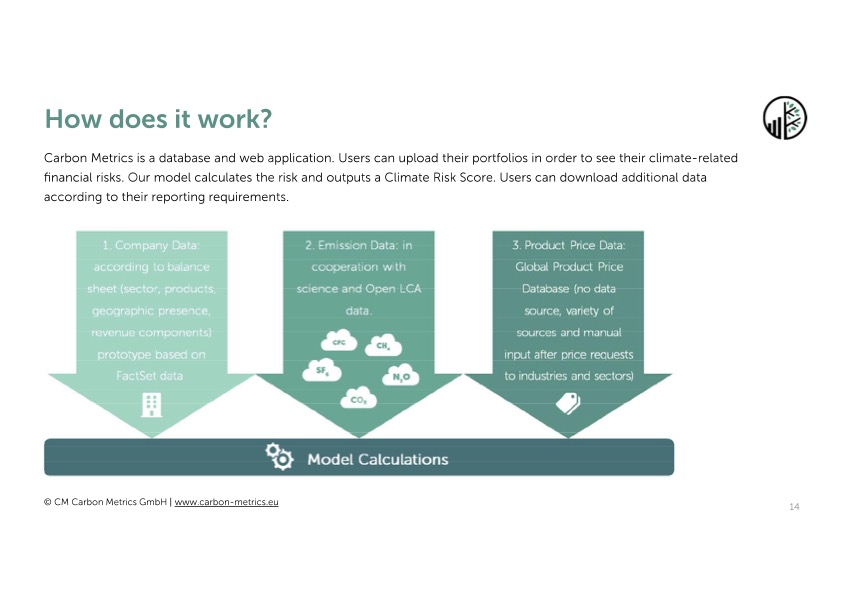

- Carbon Metrics CO2 Computation is a framework for computing associated scope 1/2/3 CO2 emissions for investment portfolios

- An underlying database per company uses our proprietary methodology to estimate both direct and indirect emissions by company.

- Emissions include supply chains emissions as well as emissions created by product use, recyclcing and disposal

- We use scientific CO2 factors associated with materials / production processes / transport etc to get a more detailed understanding per business

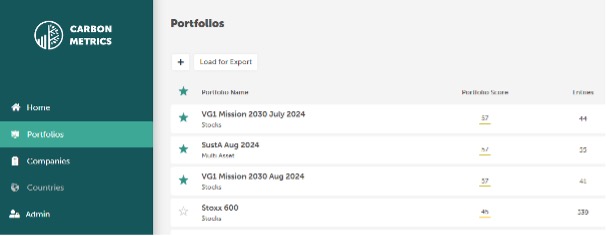

- Carbon Metrics will rate the portfolio according to the emissions of associated to the invested company

- This gives the investment manager unique insight into risks associated with CO2 emissions as well as mitigations of these risks

- Distributions according to industry, country and absolute company rating are available

- Ratings consist of generic industry ratings as well as company specific relative ratings within each industry

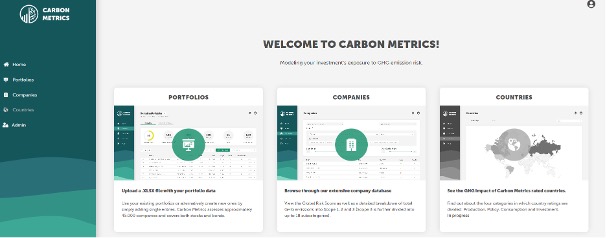

Carbon Metrics is a modelling package with associated company and factor data base to estimate total embedded CO2 emissions of investments. This is implemented as a Web service with precomputed factors that can calculate emissions of large portfolios in quasi real time. Investment data can be uploaded securely through the Web API and associated metrics produced at the touch of a button.

If you are interested to obtain more information on the Real Time Data Reporting Service please contact us on krattay@carbon-metrics.eu.